We all know that Bitcoin is the popular currency of the criminals. The fact that some honest persons are gullible enough to believe that it is a “Currency” does not create a case for sympathizing with people who might have invested in Bitcoin directly or in a business related to Bitcoin.

While technically, Bitcoin is “An Electronic Document” and is recognized in India as equivalent to a “Paper Document” and the Equivalent Paper document is deemed to say….

“This is a statement that this is a part of a bitcoin issued to wallet ID…. under block chain number…… and that …..bitcoins out of this has been transferred from …..wallet ID to ……..wallet ID”,

some people consider this as “Currency” and many people promote it and deal with it as if it is “Currency”.

However, in India, since RBI is the sole authority to issue “Currency” and it has not issued Bitcoin, making any reference to it as “Currency” is a misrepresentation and an attempt to commit fraud on the society.

Today there are thousands of persons in India who are guilty of this offence and could be rightfully questioned.

However, since the Police themselves have not understood the the real nature of Bitcoin, no action has been taken to prevent frauds on the society by people who advertise Bitcoin business, conduct promotional meetings etc.

There are also many otherwise respectable persons particularly in the tech industry who consider that Bitcoin represents a revolutionary concept of “Decentralized Monetary Control” and protects their investment from inflation, and is a symbol of “Freedom from Regulatory control of personal wealth” etc…

Ultimately, all those who are championing Bitcoin are people who are fighting for their right to hold unaccounted money and ensure that Government should not tax them for the Bitcoin wealth they posses. (Some exceptions could be there to this presumption)

After the demonetization in India, the Black Money holders who are on the run, are the dearest friends of Bitcoin and we can find such friends in many political parties as well as corrupt bureaucrats and perhaps even in the Police and Judiciary.

Recently it was reported that nine rogue police officers in Gujarat, kidnapped a businessman and extorted a ransom of 200 bitcoins (Refer article here). This shows that Police at least some of them, today are aware of the potential of Bitcoin as a proxy for “Black Money” .

Since the entire Bitcoin industry revolves around “Crime”, it is to be expected that “Bitcoin Business” is managed by people who are mentally more friendly with the criminals or are criminals themselves.

I am therefore not surprised when reports emanate that some Bitcoin exchange was hacked, Bitcoin holder was defrauded etc. I donot have much sympathy for those who lose Bitcoins also.

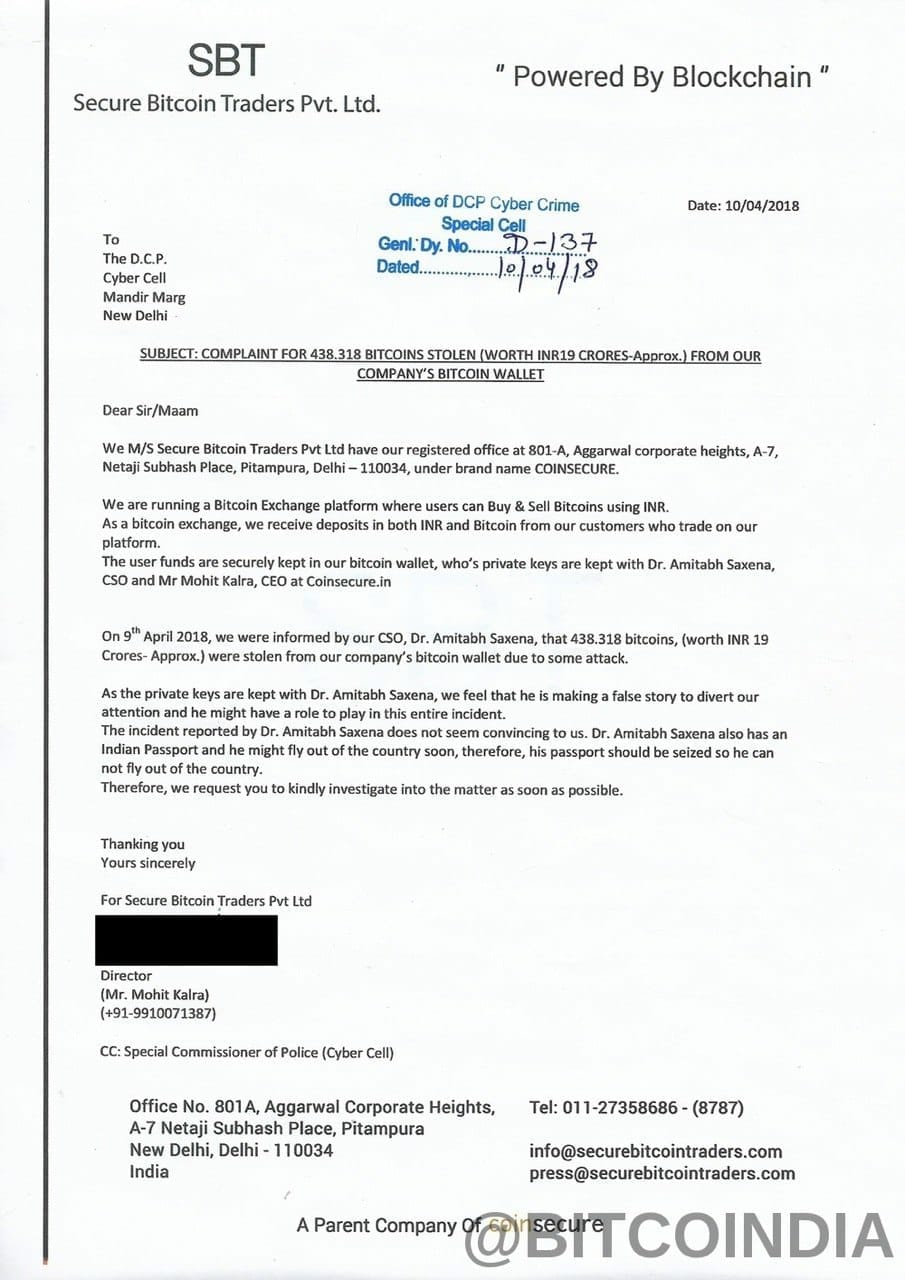

In this background it is interesting to note that a complaint has been filed by Secure Bitcoin Traders Pvt Ltd (Coinsecure.in) by its Director Mohit Kalra that 438.31859715 bitcoins were unauthorizedly moved to a BTC address as shown below:

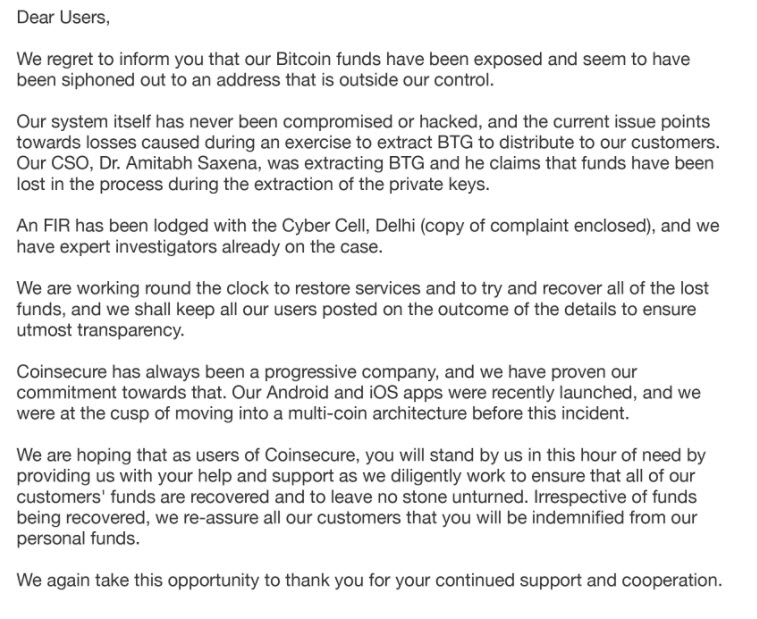

The website of the company has put up a notice on its website that users may be assured that their money was safe and action is being taken with investigation authorities.

According to the notice on the website a copy of which is given here, the Company states that the CSO Dr Amitabh Saxena while extracting the coins to distribute to its customer has reported that the private keys have been lost causing the loss of BTCs.

The Company has now filed a complaint, at Delhi and the Police have registered the Complaint as indicated below.

This is not the first time that a Bitcoin Exchange has reported an attack and loss of Bitcoins from its storage. The value of the Bitcoins reported lost in the current incident is more than 22 crores and as per the above documents, the loss may not be of the individual customers but of the Company.

The Company states that “It feels” that Dr Amitabh Saxena is making a false story and he may have a role to play in the incident.

I am not sure if Police can file an FIR and impound the Passport of the accused based on this “Feeling”. The Company needs to provide some evidence to say that MR Amitabh is the owner of the Bitcoin wallet to which the money has been transferred. Otherwise it is speculation and there could be some other internal rivalry that may be playing out in this case.

I will not be surprised if Mr Amitabh comes out with his own story in which he may reveal that the owners of the Company have many undeclared Bitcoin wallets etc. and some such differences are behind this attempt to fix him.

The ED recently conducted a survey and all the owners of the Company should have given declarations of their own transactions in Bitcoins in the past. Now ED needs to join the investigation and find out if Mr Amitabh has a story of his own to tell.

When a gang of criminals fall out amongst themselves, Police have a field day to unearth many other crimes. In this case also many more Bitcoin deals which represent anti national activities would tumble out during the investigation.

It is likely to be a very sensitive investigation which has to be immediately taken over by CBI since locating the Bitcoin wallet owner is beyond the capability of the Delhi Police.

It’s a Challenge to the Bitcoin Community also

This will also be a challenge to the Bitcoin community itself. Will they help the law enforcement authorities to investigate and unravel the “Privacy” of the Bitcoin wallet? or will they try to preserve the integrity of the Bitcoin system by sticking to the fact that Bitcoin wallet cannot be traced?

Will the “Privacy Activists” who oppose Aadhaar because it can be a Black Money prevention tool come in support of “Bitcoin” ? or remain silent? are the interesting challenges ahead.

I believe that there is a technology (however unreliable it may be) to zero in on the ownership of the anonymous Bitcoin Wallet and if the law enforcement pursues it properly with the help of honest technologists, it may be possible to find out the ownership of the wallet in question and successfully investigate the complaint.

Will it happen? … or some time during the investigations, further flow of Bitcoins to other wallets will result in its closure as “Unresolved”? …only time will tell.

Legal Perspective

While looking at the complaint that bitcoins were “Stolen” from “Company’s Bitcoin wallet”, I am reminded of the complaint in the year 2000 (before ITA 2000) when in Delhi there was a complaint about “Theft of Internet Hours”. At that time there was no ITA 2000 and what had happenned was that a person who installed the internet account for the customer gave away the password to a cyber cafe who cleaned out 100 hours of internet browsing time within a day. The user complained that “My Internet hours were stolen”. I had discussed at that time that it could be a case under “Breach of Trust” etc since it may not fit into “Theft” under IPC since “Internet Browsing hours” is not a “Movable Property”.

A similar discussion now is relevant. The complaint is that there was an “Unauthorized Electronic Document related activity” resulting in “Wrongful loss to the company”, Suspected to be from one of the employees.

Now the way the Complaint has been lodged by the Company which I consider was not a wise thing for the company to have done rather than gulping down the loss however unpalatable it could have been. According to the complaint, it is a case of “Unauthorized Access” under Section 43 and Section 66 of ITA 2000/8. There could be Section 66C and 66D but it is not clear.

Before the crime is recognized, there has to be an “Evidence of Crime”. We need to know whether 438.31859715 bitcoins were actually available in the Wallet account and it is no longer there. Company has to prove that this wallet account belonged to the Company and it had authorization under FEMA and RBI to open the account and conduct all the transactions it did in the past in the account. This is where ED can catch the company by its scruff and ask for details of each and every transaction that occurred in the wallet and whether they were transactions that were declared in the ED survey or were concealed.

Of course this evidence has to be Section 65B certified.

Then Mr Amitabh has to be questioned on how does he normally extract BTC from the Company’s vault and distributes? … past examples…. (again to be checked and verified with the company’s IT declarations) etc…. again all to be Section 65B certified.

Next is the identity of the Wallet… Who is the Wallet service provider… Is he Indian or not?… Does he come under the jurisdiction of Section 75? … Does it require Interpol assistance for which CBI involvement is mandatory? ..

Overall it is an interesting investigation to follow. Coin Secure by filing the complaint has given an authority for the Police, CBI, Regulators like RBI and the Indian Courts to tear into the system of Bitcoin management and expose all the nefarious things that happen in the Bitcoin industry.

But the stakes are so high, that unless there is monitoring of the case by public spirited Court and Media, the case will get buried.

Perhaps Mr Modi has to instruct Mr Rajnath Singh to take personal interest in this investigation and take it to the logical end. The Finance Ministry is suspected to have many Bitcoin sympathizers and investigation at their level may not be trustworthy.

Let us wait and watch this interesting battle.

Naavi

(P.S: Parts of the article may be unpalatable to some. Kindly excuse me. Consider that I am just making a larger point. )