When Section 66A of ITA 2000/8 was scrapped, by the Supreme Court in 2015, most people hailed the decision of the Supreme Court as a torch bearer of “Freedom of Speech”.

Naavi.org had its reservations on the scrapping since it felt that the Supreme Court had come to a wrong decision by not distinguishing between “Publishing” and “Messaging” and also for not reading down the section instead of scrapping it all together along with the provisions related to Spamming, Cyber Stalking, Cyber Bullying, Cyber extortion, Cyber harassment etc.

The Central Government has not since then come up with an alternative to Section 66A and only trying to work with tinkering of the Intermediary guidelines in a half hearted manner. Hence fake news and cyber defamation continue without appropriate controlling measures under ITA 2000.

The inability of the Central Government to come up with an alternative to Section 66A since 2015 when the judgement was pronounced has now lead to a situation where Kerala Government has come up with an Ordinance under the State Police Act which challenges both the Supreme Court as well as the Central Government’s powers and intentions to regulate the Cyber Space.

Section 90 of ITA 2000 states as follows:

Power of State Government to make rules

(1) The State Government may, by notification in the Official Gazette, make rules to carry out the provisions of this Act.

(2) In particular, and without prejudice to the generality of the foregoing power, such rules may provide for all or any of the following matters, namely

(a)the electronic form in which filing, issue, grant receipt or payment shall be effected under sub-section (1) of section 6;

(b)for matters specified in sub-section (2) of section 6;

(3) Every rule made by the State Government under this section shall be laid, as soon as may be after it is made, before each House of the State Legislature where it consists of two Houses, or where such Legislature consists of one House, before that House.

Since ITA 2000 was a central law, it was interpreted that under Section 90, States only have powers to frame rules for implementing the provisions of the law and not frame new laws by themselves.

However, under the argument that “Law and Order” is a state subject, some States made laws under their Police Act applicable to Cyber Cafes, Online Gaming etc. Now this trend has been extended to the Kerala Government’s Ordinance related to “Publishing of information in electronic form”.

Copy of the Kerala Ordinance

The Kerala Ordinance states as follows:

Amendment of Section 118 of Kerala Police At 2011 (8 of 2011)

In the principal act after Section 118, the following section shall be inserted namely:

118A: Punishment for making, expressing, publishing or disseminating any matter which is threatening, abusive, humiliating or defamatory:-

Whoever makes, expresses, publishes or disseminates

through any kind of mode of communication,

any matter or subject

for threatening, abusing, humiliating or defaming a person or class of persons,

knowing it to be false and

that causes injury to the mind, reputation, or property of such person or class of persons or any other person in whom they have interest

shall on conviction, be punished with imprisonment for a term which may extend to three years or with fine which may extend to ten thousand rupees or with both.

Presently it is being interpreted that this ordinance is applicable for publications in Twitter or FaceBook or other social media. The LDF government has reportedly said that this amendment was done to ‘control cyberbullying’.

We can look at the impact of this ordinance under two assumptions.

Firstly, the ordinance uses the term “any kind of mode of communication”. This does not specify that “Electronic Communication” is part of the ordinance. Since legal recognition to electronic document as equivalent to paper document was provided through ITA 2000 which is a central law and Section 90 of that law restricts the powers of the police to only issue rules for implementing the law as provided there in and not introduce a new penal section with imprisonment etc., it can be argued that the ordinance may not be applicable for electronic documents.

The legislative intent of the Police Act is also to be considered as restricted to the regulation of the police activity and ideally it should refrain from passing a law carrying punishments unless that is related to the prevention of carrying out of duties of the Police as envisaged under the Act.

For example if the defamation is of a “Police Officer” and aimed at preventing him from discharging his duties, then the Police Act could be considered as having jurisdiction to make regulations.

But infringing on a Central Law meant to provide legal recognition to electronic documents and regulate crimes associated with cyber crimes, should be considered as ultra-vires the Section 90 of ITA 2000.

It is however possible that this view may not be acceptable to the majority of legal professionals who may say that “Maintenance of Law and Order” includes regulating the Cyber Activities and hence the State Government has the power to make laws of this nature.

While we donot support this view, we can continue our discussion further presuming that this is the popular and acceptable legal position.

Under this assumption. “Any Mode of Communication” used in the ordinance may be considered as inclusive of electronic mode of communication and hence the social media comes into relevance.

The clarifications given by the politicians indicate that this law is not meant to regulate the “Media” and hence it may be used only to punish “Individual Citizens” who express themselves on platforms which are not considered as “Social Media”.

A doubt that comes to the mind here is, If Twitter is a Social Media and Kerala Government does not want to apply this law to Twitter, then a contributor to the social media called Twitter may claim to be a “Social Media Journalist” and his publication becomes “Social Media Journalism”. Hence politicians are assuring that they may not be targeted.

However, since no body believes the politicians this assurance has no meaning.

The next point to be noted is that this section will be applicable only for postings which are “Known to be false”. If the person posting the message does not “Know” that it is false but believes that it is “True” or it is in fact “True”, then the section is not applicable.

This means that unless there is a prima facie evidence established by the Police that the information is “false and the person is aware that it is false”, there is no cause of action under this section.

The section requires “injury to the mind, reputation, or property of such person or class of persons or any other person in whom they have interest“.

It is not clear what is meant by “in whom they have interest”. Perhaps this could be interpreted that the person to be charged should have an intention to defame a person in whose defamation there must be some interest of the person.

If we presume that Kerala Government has the power to make laws covering Cyber defamation or Cyber bullying as was the scope of Section 66A of ITA 2000, then the amendment is a direct affront to the Supreme Court in the Shreya Singhal judgement.

If the power of the Kerala Government to bring out this law for punishing use of electronic documents as part of an expression of opinion as per the “Freedom of Speech” enshrined in the Constitution, then every State Government may make their own Section 66A and later every other section of Chapter XI of ITA 2000 and create their individual versions of ITA 2000.

This will lead to a chaotic situation and breaking the structure of the Union of India. Hence it has to be curbed at the very beginning itself.

In order to ensure that ITA 2000 remains the only law for regulating electronic documents, it is necessary for the Government to recognize that “Cyber Space” is a different jurisdiction which should not be considered as belonging to a “State”. It should be always at the Union Level . Hence Cyber Laws should belong to the Central Government. The implementation can be delegated to the local police but law making should remain with the Center.

As a further improvement, the implementing Police can also be made a “National Unit” and brought directly under the Union Government administration so that Cyber Police will be a national cadre. This will enable better expertise to be built up and resources to be shared.

If Cyber Laws are allowed to be created and implemented under local laws of the State or later under Municipalities etc., then movement of people within the country would be highly restricted since police in one state will start enforcing their writ in another state and people would not like to travel to a state at which any of their twitter posts may be found objectionable.

The way police in a state implement the law is best showcased by the Maharashtra Police under the Shivsena Government and no person will be safe in expressing any opinion which may remotely be objectionable to a politician in a rogue state.

The Kerala Ordinance should therefore be seen in this context of creating a highly objectionable precedent and hence should be scrapped forthwith.

Naavi

P.S: ” Responding to the adverse views about the Ordinance, the Chief Minister of Kerala has made an announcement that the provisions of the Ordinance will not be implemented. However, the ordinance needs to be withdrawn by the Governor officially or allowed to lapse. However the principle of Cyber legislation to be in the central domain as a legislation of Cyber space needs to be pursued.”

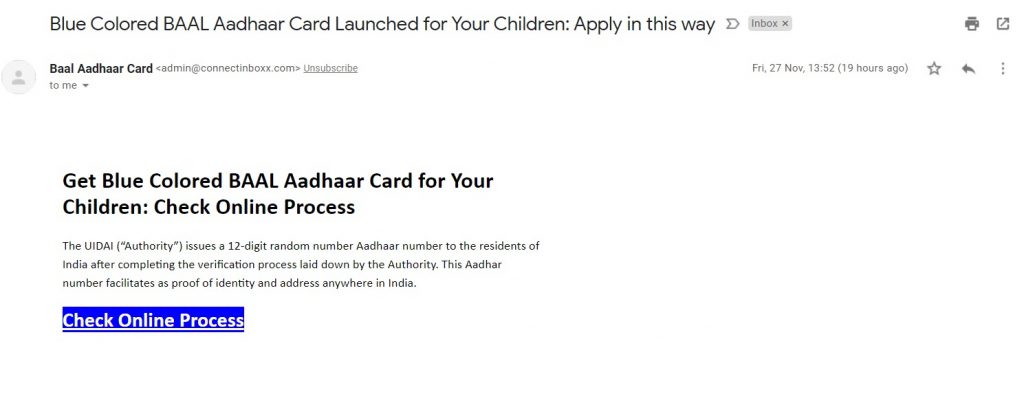

The hyper link leads to a website www.yojanakhabar.com looking as follows:

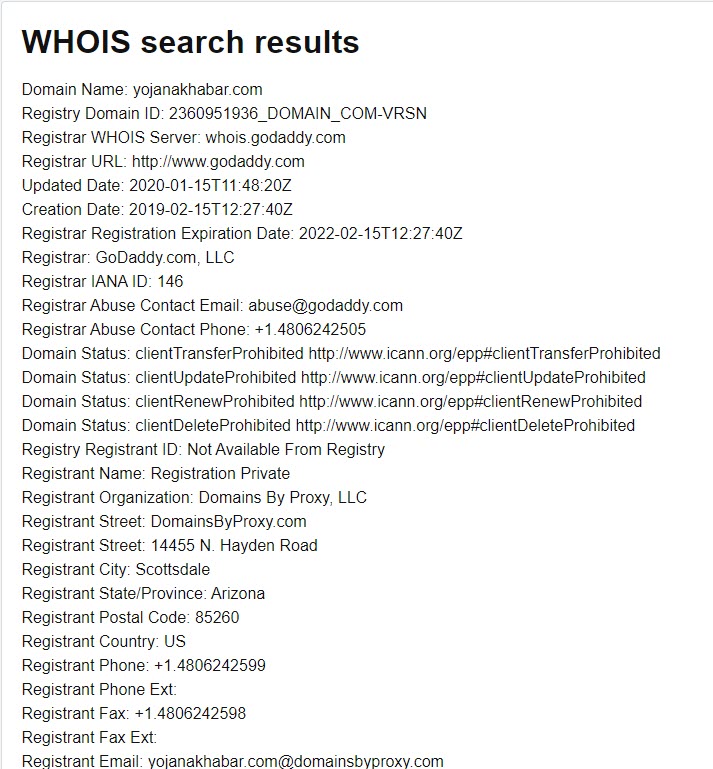

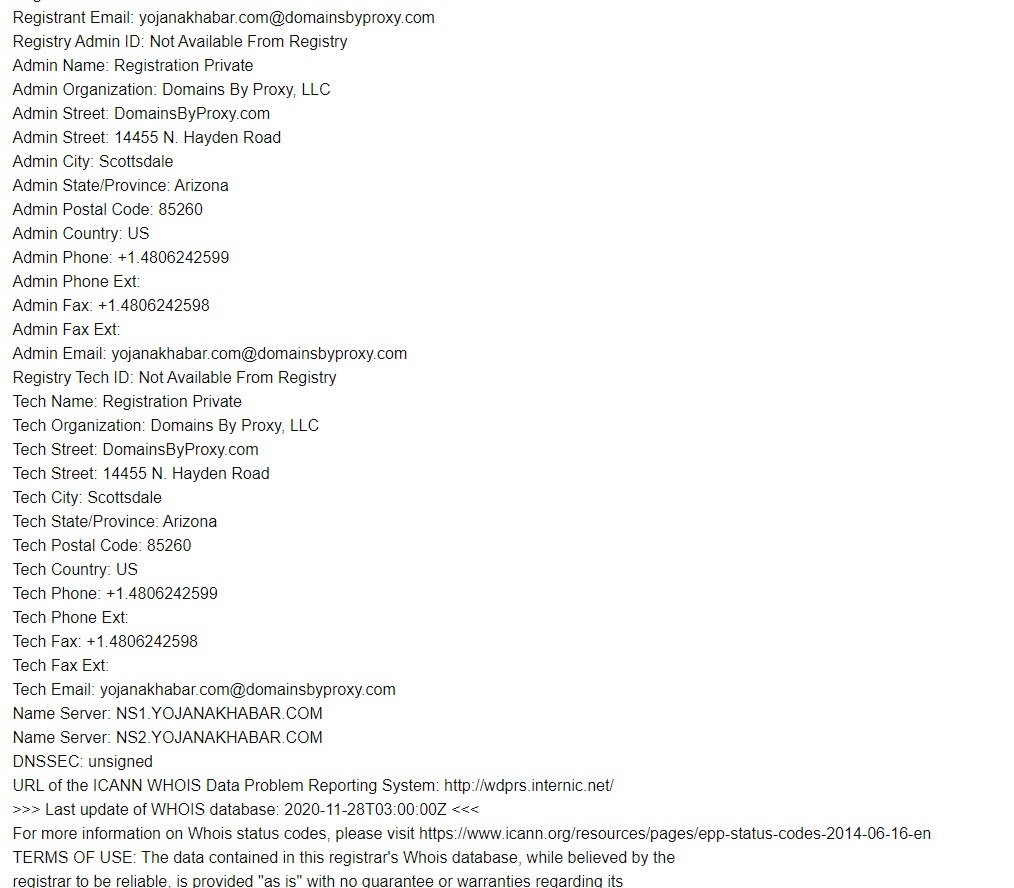

The hyper link leads to a website www.yojanakhabar.com looking as follows: The website is registered by an Arizona resident as indicated below:

The website is registered by an Arizona resident as indicated below:

This appears to be a “Phishing Website” and action is required to initiate Cyber Crime complaint against the Registrant who is assisted by the intermediary the Registrar.

This appears to be a “Phishing Website” and action is required to initiate Cyber Crime complaint against the Registrant who is assisted by the intermediary the Registrar.