This is the personal view of an honest citizen and is not related to any professional or organizational activities. Also I do hold Mr Modi, Mrs Nirmala Sitharaman in great respect but in respect of this issue of legitimizing Crypto Currencies through back door, I donot hesitate to call them out as not being honest in their efforts. The country is more important than the individuals and some body should call out the fakery being indulged by the Finance Ministry for whatever legitimate reasons which makes even Mr Modi to remain in support.

Naavi

———————————————————————————————————

To

Mrs Nirmala Sitharaman

Honourable Finance Minister of India

Delhi

Madam Finance Minister,

I am sure you would not like what I want to say. But let me make it clear that we the honest tax payers of the country also do not like what you are doing in connection with the legalization of Crypto Currencies.

In your budget speech and even in some of your interviews you made the “Typical UP ran away MP” kind of statements denying that you are not recognizing Crypto Currencies by introducing a tax of 30% and TDS. You stated that these are related to “Digital Assets” and not “Crypto Currencies”.

I am not sure you are so naïve as not being able to understand the impact you have created in terms of the perception of the market on legitimization of Crypto currencies. I tried earlier to credit you by saying that “You have been tricked” by the industry. But on second thoughts it appears that you have been trying to trick the public with your false statements. You have deliberately and not so cleverly tried to be the torch bearer of Crypto Currencies in India and for destroying the economic system as we know of.

I add that I have also been disappointed with Mr Narendra Modi and at this point of time, I would say that he has not been allowed to understand the real impact of what you have done.

I am sure that your subordinates must have given you an estimate that there are 15-20 million crypto investors and all of them will come to your tax net and 30% of annual appreciation could amount to hundreds of millions of dollars etc…. This could have blinded many into believing that what you are doing is good.

You know and I know and all honest tax payers know that if you create any loophole for tax evasion, the market is intelligent enough to exploit it. At the end of the year you would realize that Crypto currency prices are booming but your tax collection would be shrinking. mark my word and let us review this after April 2023 and see whether my prediction would be correct.

I suppose you are watching the debates on the TV as well as the articles in news papers.

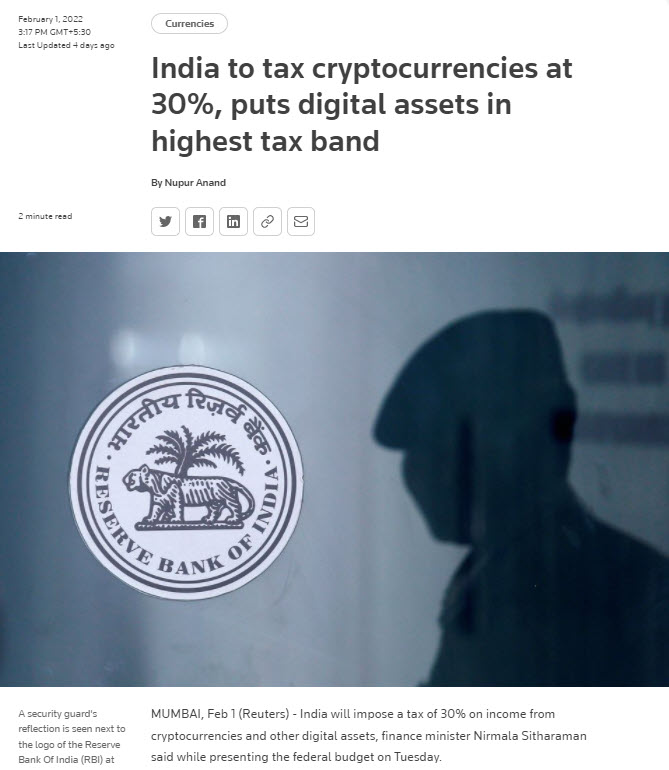

The Reuters report says

“India to tax cryptocurrencies at 30%, puts digital assets in highest tax band”

Does this say that Crypto Currencies are not recognized or that Bitcoin etc is not a Crypto Currency but only a “Digital Asset” as you term it?… No because this is the perception of every body other than you and your false propaganda machine.

Listen to what the industry says…

“Thirty percent tax on income from virtual digital assets, while high, is a positive step as it legitimises crypto and hints at an optimistic sentiment towards further acceptance of crypto and NFTs,” said Avinash Shekhar, chief executive of ZebPay, a cryptocurrency exchange.

The report also says “Crypto exchanges also hoped the the new tax regime would signal acceptance of digital currencies by the authorities, and reassure corporates that they can enter the market.”

Can you see how happy the industry is for your legitimisation of Crypto currencies? Do any of these people think Crypto currencies are still illegal?

The report also gives credit to your statement “The introduction of a central bank digital currency will give a big boost to the digital economy. Digital currency will also lead to a more efficient and cheaper currency management system,” which is another false bogey you are spreading.

The Economic Times which is the mouthpiece of the Crypto industry says ” Crypto Industry celebrates breakthrough moment..”

In another article in ET, Experts are quoted as statitng

“For years, there have been reports of an imminent ban on private cryptocurrencies in India but today’s announcement closed that chapter, crypto industry stakeholders, including founders, venture capitalists and policy experts, told ET.”

The Finance secretary is also quoted as saying

“ cryptocurrencies will remain legal in India as long as there is no blanket ban.”

Are you such an ill informed person not to see that your move is only seen as legitimization of the Crypto Currencies and nothing else. So far it was only the gullible individuals who were attracted to this form of investment but now you have opened it out to the corporate entities.

I am sure that your election machinery would also welcome the move since they can attract black money contributions to your party’s election fund.

In case you donot understand, let me re-iterate,

Once you start allowing Crypto currencies to be represented as “Assets” in the official tax records of either an individual or a company, you are legitimizing their presence as a class of assets. This is the view of all experts and it will be also the view of all sane persons. You and your team may be trying to spread disinformation in the public that “Taxing” is not “Legitimization” but this is a fraud you are trying to commit to convince the public that you are not supporting the development and use of digital black money which is also the currency of the criminals and terrorists.

The CBDT digital currency is another canard you are spreading as if it is a great boost to the economy. It only allows you to issue currencies at will and though it is considered traceable, it is subject to its own risk of anonymization and duplication. The cost of duplication of digital currency is much less than duplication of printed currency. Hence the problem of fake currency will continue in a different form. Since it will be traceable, it will not carry any premium and it will be nothing different from the virtual bank balances.

Public are not fools to believe whatever you may say to justify your support to crypto currencies.

The individuals who will purchase Crypto currencies through the exchange will not be TDS deduction entities and hence no TDS will be collected by them. Only corporates may be liable to deduct TDS.

The liability to pay tax arises only at the time of its sale at a profit. If the asset is not sold or sold at a loss, then there is no tax payable and TDS can be recovered.

I need not say how the stocks can be liquidated at a loss whenever an opportunity arises and shown as rebought at a higher amount by creating a benami wallet account in a foreign country.

You will therefore not get the expected tax revenue and only the tax consultants will benefit by the various schemes they may introduce for such “Crypto Tax Avoidance Schemes”.

The Crypto exchanges will provide easy opportunity to transfer the Crypto assets in India to a foreign wallet and ensure that money gets transferred out of India without the CBDT or ED coming to know.

Exporters will start invoicing in cryptos and park their money abroad and this will show as “Decrease in Exports” and lowering of GDP in the coming days.

Bankers will find that the virtual rupee balances will get slowly converted into crypto assets and they will be left to handle only the lower end customers who will Bank for the same of loans and not for savings.

In your budget we note that there is no incentive for savings and this is another ploy to move the community of savers from Bank deposits to Crypto currencies.

Together you have implemented a devious plan to destroy the Banking system in India.

If you disagree with my statements, Please feel free to write to me at naavi9@gmail.com and justify that your intentions were honest.

Na.Vijayashankar

37, 20th main, BSK first Stage, Bangalore 560050