Over the last few days the arrest of the executives of Unocoin the Bitcoin trading company for installing a “Bitcoin ATM” in Bangalore is making news. There are views and counter views on whether it was fair to arrest the two executives, whether any offence was committed etc. In this context it is interesting to observe how the representatives of the Company are defending themselves in the Public with statements which either make either them or the Press which has quoted them earlier liers.

The public wants to know who is lying.

According to this report in Deccan Herald, the legal adviser of Unocoin, Mr Swaroop says “…The general public referred to the kiosk as an ATM, which perhaps added to the misunderstanding and police action…”The Company never termed it an ATM”.

Mr Anand Swaroop also said “The kiosk had been set up but wasn’t operational. “There are certain bugs which we are addressing and the kiosk isn’t live yet,”

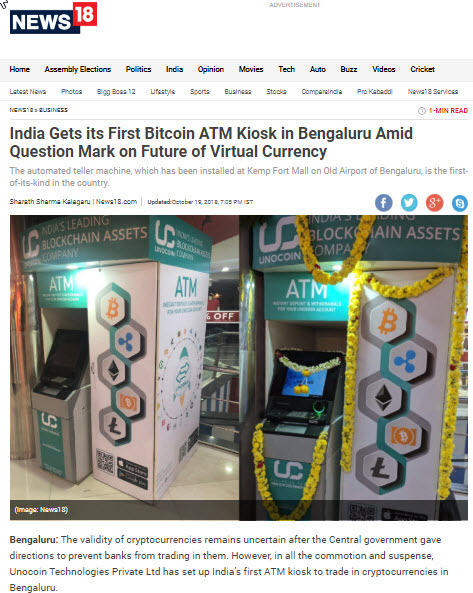

But, look at the photograph above and the word “ATM” is written all over it. So, it is not the public or the press to be blamed. The Company wanted it to be called a “Bitcoin ATM”.

Now see the words spoken by Mr Sathvik in his interview

He says “We have completed our trials on Thursday afternoon. We have completed all the procedures. It will go live on Monday morning,” (Ed: This interview was published on October 19th and “Monday” referred to 22nd October 2018).

Sathvik also explained in his interview credited to Mr Furquan Moharkhan of the DH News Service, that

“…The company has made adjustments to a normal bank ATM to equip it for cryptocurrency transactions….We have purchased the same ATM machine that banks will install for customers, but we have modified the software to contact our servers,” .

He also confirmed

“In order to deposit money into the ATM, KYC compliant customers have to enter their user ID and the OTP that they receive as an SMS on their registered mobile number. The user will then confirm his account details and deposit the funds into the machine. Their Unocoin account will be updated with the deposited funds immediately. And these funds can be used to buy Bitcoin or Ethereum, or on Unodax place BID orders on 30 different crypto assets.”

Mr Sathvik was fully aware of the views of the regulators in India and conspired to beat the system as his words below indicates.

“Due to the RBI’s recent notification on ‘Prohibition on Dealing in Virtual Currencies’, Unocoin’s banking relationships were disrupted. Since then, the company has been in the process of deploying new mechanisms for rupee deposits and withdrawals. The company is also planning two more such ATMs in Mumbai and Delhi.”

It is therefore unbecoming of the advocates representing the Company to now claim that it was only a “Cash Machine” to deposit and withdraw money from the Company” and it was not meant to be a “Bitcoin Converter”.

The machine was meant for people to deposit cash into the Company, authorize the company to buy any of the 30 Crypto currencies from other exchanges and credit it to the Crypto wallets. The customer of Unocoin may under go a simple verification based on a SIM card which may or may not be KYC compliant, but the counter party which sells the crypto currency is unknown and untraceable.

Similarly, when the Unocoin customer sells his the Crypto Currency, the buyer who pays cash is not known.

The counter parties who sell or buy may come from abroad and hence the machine will facilitate conversion of INR to Foreign Exchange.

Business Standard headlined its report on October 20, as “Soon you can pay cash and get bitcoin, other cryptocurrencies at nearby ATM”

This report also was based on an interview with Mr Sathvik and leaves one in no doubt of what the Company intended to do and exposes the lies that are being peddled now to defend the promoters.

Police have booked the case under Section 66 of ITA 2000, Section 120b, 420, 465, 474 and 471 of IPC. Perhaps more sections can be added under FEMA and RBI Act. There is a conspiracy, an attempt to cheat and violation of Foreign Exchange regulations etc. Hence Police has a strong case particularly under IPC though the evidences are in electronic form. The website of Unocoin would also be a key evidence.

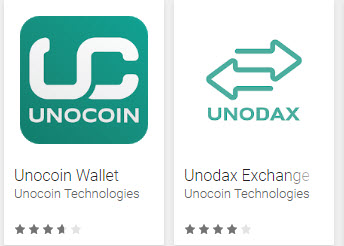

The Google Apps

The ATM has a prominent display of a QR code which is for downloading an App. If we search the Google play store, we find the following two Apps provided by Unocoin.

The Unocoin App is a wallet. The details about Unocoin mentioned here are as follows:

About Unocoin

Unocoin is India’s leading Crypto asset & Blockchain company with over a million customers. We make it easy to buy, sell, store, use & accept crypto assets securely in India.

• Raised 2.5 million USD in pre-series A funding from top investors like Blume Ventures, ah! Ventures, Mumbai Angels, Boost VC, Digital Currency Group, FundersClub, Future Perfect Ventures, Huiyin Blockchain Ventures.

• Featured among the top 20 out of 350 companies in The FinTech 20: India list.

• Unocoin is a member of NASSCOM.

• Picked amongst top 30 technology startups for Tech30 2017 by YourStory India.

Unocoin has one mission – “Bringing bitcoin to the billions”.

Highlights

– Buy/Sell bitcoin/ether instantly

– Low transaction fees

– Consolidated wallet for crypto-holdings

– Live price tracker widget

– Transact (Send/Request) in bitcoin/ether

– Accept/Request bitcoin/ether

– Deposit/Withdraw INR

– Mobile/DTH Recharge with bitcoin

– Offers pertaining to bitcoin in India

– Latest updates/news from Unocoin

– Bitcoin/Ether SBP subscription

Hedge against the market volatility using Unocoin SBP (Systematic Buy Plan) module to automate bitcoin buying with fixed amount and frequency.

– View Merchant transactions

Enabling merchant gateway would provide complete history of merchant transactions processed on all the paired devices.

– Earn free bitcoin referring Unocoin to your friends

What is bitcoin?

• Bitcoin is often referred to as “A peer-to-peer decentralised digital currency”.

• Bitcoin was first invented in 2009 by a pseudonymous identity called ‘Satoshi Nakamoto’.

• Bitcoin is the pioneer of cryptoassets – type of digital assets in which advanced encryption techniques are used to regulate the generation of new token units and verify the transfer of funds, operating independently of a central bank.

• Bitcoin is set to solve a major problem of digital era – “trust” opening up avenues of new industries.

To learn more about Bitcoin: https://wikipedia.org/wiki/Bitcoin

Unocoin blog for latest updates

Keep updated with the latest trends, bitcoin & blockchain happenings and merchant partnerships for bitcoin payments at https://blog.unocoin.com and get involved in hot discussions in the Crypto asset space.

For important alerts, please look forward to https://news.unocoin.com

Youtube channel for help

Head on to our YouTube Channel ( https://m.youtube.com/channel/UCxTztdOn_HjYhMGiT8su6Bg) for more detailed step-by-step tutorials on availing services from https://unocoin.com along with the happening in the bitcoin space.

Support details of Unocoin

For further support please go to https://www.unocoin.com/support

Mail: support@unocoin.com

Toll free number: 1800-103-2646 (24/7 Services)

Conditions Apply

For detailed terms & conditions, please refer: https://www.unocoin.com/post/98

The Unodox is an Exchange App the details of which are presented as follows:

About Unodax

Unodax is India’s Leading Digital Asset Exchange, powered by Unocoin with over a million customers. We make it easy to buy, sell, store, use & accept cryptoassets(BTC, ETH, XRP, LTC, BCH, BTG…) securely in India.

• Raised 2.5 million USD in pre-series A funding from top investors like Blume Ventures, ah! Ventures, Mumbai Angels, Boost VC, Digital Currency Group, FundersClub, Future Perfect Ventures, Huiyin Blockchain Ventures.

• Featured among the top 20 out of 350 companies in The FinTech 20: India list.

• Unocoin is a member of NASSCOM.

• Picked amongst top 30 technology startups for Tech30 2017 by YourStory India.

Unocoin has one mission – “Bringing bitcoin to the billions”.

Highlights

– High-frequency order matching engine with an open order book

– Supporting multiple cryptoassets

– Transact (Send/Request) in cryptoassets

– Accept/Request cryptoassets

– Deposit/Withdraw INR

– Crypto Basket (place basket orders now)

Cryptoassets supported on the exchange:

Bitcoin: Bitcoin is peer-to-peer electronic cash for the Internet. It is fully decentralized, with no central bank and requires no trusted third parties to operate.

Ethereum: Blockchain based distributed computing platform featuring smart contract functionality.

Litecoin: Litecoin is a peer-to-peer digital asset that enables instant, near-zero cost payments to anyone in the world.

Ripple: The world’s only enterprise blockchain solution for global payments.

Bitcoin Cash: Continuation of the Bitcoin project as peer-to-peer digital cash forked from the Bitcoin blockchain ledger, with upgraded consensus rules that allow it to grow and scale.

Bitcoin Gold: Bitcoin Gold is a Hard Fork that allows you to mine Bitcoin with GPU. BTG implements a new PoW algorithm, Equihash, that makes mining decentralized again.

Civic: Civic provides blockchain-based, on-demand, secure and low-cost access to identity verification (IDV).

Tron: TRON is a world-leading blockchain-based decentralized protocol that aims to construct a worldwide free content entertainment system with the blockchain and distributed storage technology.

Crypto Basket:

Go a step further in placing an order with new weighted basket orders. Presenting ‘Crypto Basket’ on Unocoin Exchange – Read more about ‘Crypto Basket’ click here.

Unocoin blog for latest updates

Keep updated with the latest trends, bitcoin & blockchain happenings and merchant partnerships for bitcoin payments at https://blog.unocoin.com and get involved in hot discussions in the Crypto asset space.

For important alerts, please look forward to https://news.unocoin.com

Youtube channel for help

Head on to our YouTube Channel ( https://m.youtube.com/channel/UCxTztdOn_HjYhMGiT8su6Bg) for more detailed step-by-step tutorials on availing services from https://unocoin.com along with the happening in the bitcoin space.

Support details of Unocoin

For further support please go to https://www.unodax.com/contactus

Mail: support@unocoin.com

Facebook: https://www.facebook.com/Unocoin

Twitter: https://twitter.com/Unocoin

24/7 365 days support service.

Telegram: http://t.me/Unocoin_Group

Toll-free number: 1800-103-2646 (24/7 Services).

Conditions Apply

For detailed terms & conditions, please refer: https://www.unodax.com/termsofuse

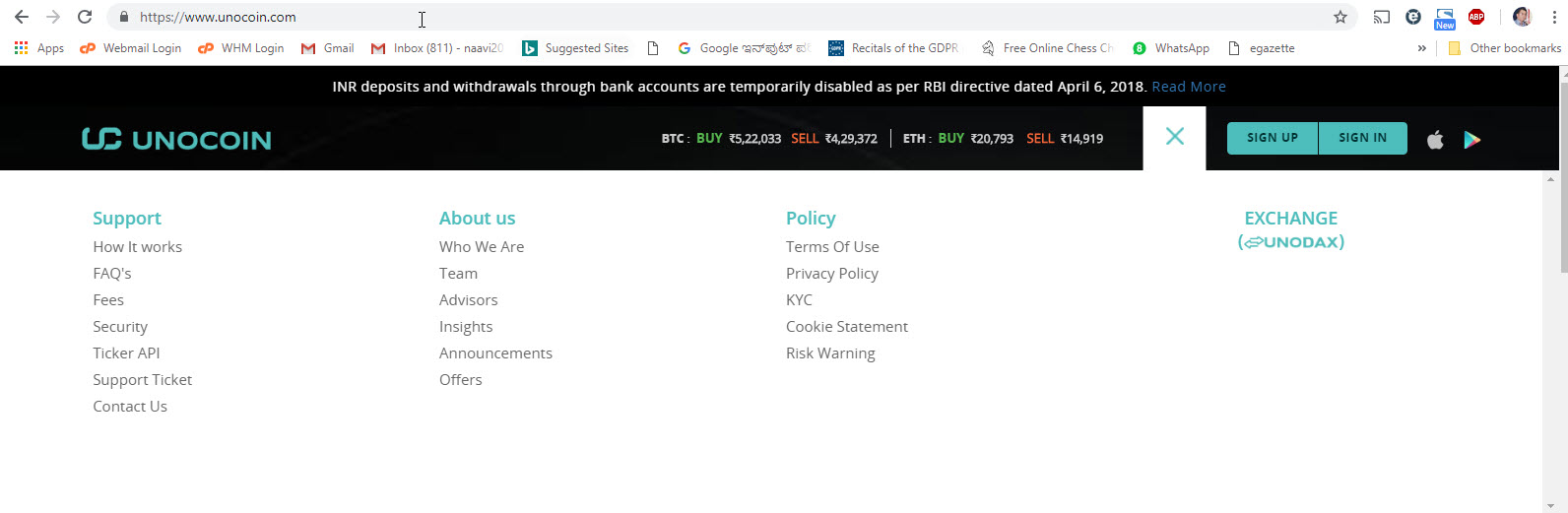

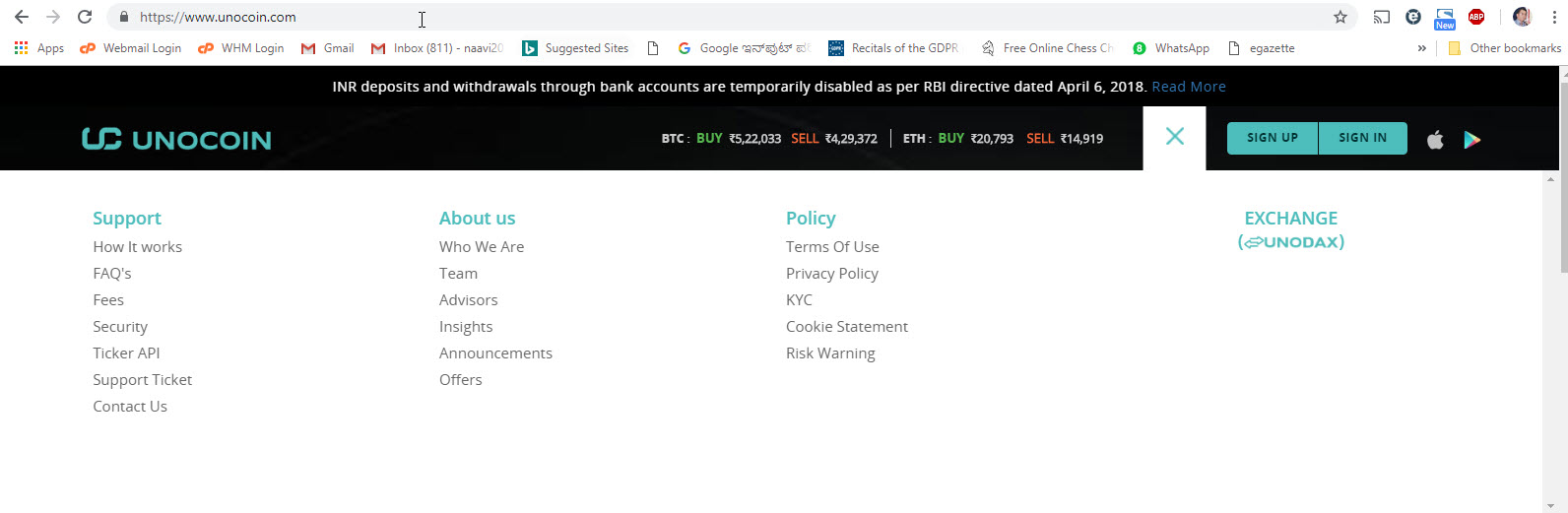

The above details along with the information on the two websites unocoin.com and unodax.com and the related Youtube channels provide enough information on the activities of the company.

The Unocoin website has the following menu items with further details

Possibility of Tampering with the Evidence

I anticipate that Unocoin would be advised by its well wishers to immediately delete the contents of the Google Playstore as well as the website.

I therefore request the Police to immediately secure this evidence.

I also notify that if any persons including the advocates of Unocoin advise and get the website or playstore information deleted, it would be considered as a further offence under Sections 65 of ITA 2000/8 and Section 204 of IPC since they are identified as “Evidence” in an investigation of a “Cognizable offence”.

I also anticipate that there could be pressure on the honest investigating officers continuing the investigation and taking it up to the logical end and senior police officers should take care that this does not happen.

Once again, I appreciate the Police for their work so far. According to the statement of Mr S. Girish, DCP, who perhaps is the IO, they consider the ATM set up as a means of “Gambling”.

It is Economic Terrorism

But actually the offence is much more than this. The Bitcoin and Crypto Currency business is an “Offence Against the State”. It is an attempt to run a parallel economic system causing a destabilization of the economy. It is therefore an act of “Economic Terrorism” and has to be treated as such.

If according to the plans of the Company such ATMs had come up across the country, it would have meant that there would be a national chain of virtual havala centers and it would have created a huge blow to the fight against black money in India. This national impact of the intended business model has to be recognized and brought into the investigation.

Naavi

Harsih a few days back. It is unfortunate that the company Unocoin and it’s promoters find themselves in this predicament.

Harsih a few days back. It is unfortunate that the company Unocoin and it’s promoters find themselves in this predicament.