One of the interesting aspects of COVID 19 Lockdown is the emergence of new paradigms in HR. It appears that the HR practitioners need to re-skill themselves in several aspects of motivation and leadership as the established theories are getting outdated.

It is a fact that after three months lockdown as the industries open out, they are receiving an unexpected response from many employees who are preferring to continue the “Work From Home” (WFH) practice as a more long lasting practice. This has set the industries thinking on their long term strategies of employee engagement.

It is a fact that in the IT industry, productivity has not suffered much because of the lock down. Many individual employees have actually improved on their productivity and also achieved better work life balance.

The situation is not the same in manufacturing organizations or where a team effort is critical for creative output.

Also there are people who enjoy the company of their family members and those who are not. This has also given raise to more domestic conflicts.

Nuclear families with responsibility to take care of children are in another peculiar situation where the employers are calling the employees back to work while the schools are not ready for physical classes. Hence looking after the children is another reason why some employees donot want to return to work.

HR also have the problem of new recruitment and possible moonlighting by employees.

All these issues are beside the security issues which the security professionals are trying to address separately.

Legal departments are also struggling with their contracts with the customers and how to accommodate WFH into their contracts.

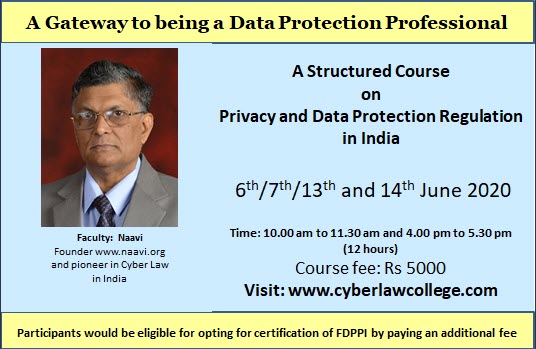

An interesting discussion was held by FDPPI under its Jnaanavardhini series of webinars on 10th June 2020 where a Behavioural science trainer discussed the HR issues arising out of the Covid.

In the coming days, we may have to classify our present and prospective employees who may be technically skilled to use technology for work as two principal types namely the “Lone Wolf” and “Hunter in Pack”. or the “Family Type” and “Company Type”

The Lone wolf will be happy to work from home and deliver. He may sleep upto 9.00 am, does not shave, works in shorts, but works upto 2.00 am in the night to finish the task given to him. As long as the task is well defined, he is happy to work alone. This is best suited for individual software employees who need to code.

The Hunter in Pack however needs peer nudging to activate his creativity and will go into depression if he is not with the team.

These attitudes may also reflect in whether a person has a happy family to support him or depends on the work place facilities like the canteen the gym etc.

A recruiter therefore has to design methods of identifying the type of employee and fit him into the corporate environment. The “Return to Workspace” option also has to be designed to meet the type of employee and the nature of his activities. Projects may have to be redefined as “Team Only”, “WFH compatible” etc.

The team leads also need to be comfortable with the different types of engaging with the team members. They have to be adept both in physical brain storming meetings as well as the virtual meetings.

Probably we need to design specific training programs to develop a new “Virtual Leadership” capabilities which will help the leader to “Virtually Motivate” his employees into action.

These are new areas of research and perhaps we need to add to the current motivational and leadership theories.

There is also a challenge when we recruit some body under the Covid conditions, train them up and later we have to move back into the old system. The some of the people who are well entrenched into the current work-life balance will consider giving up their jobs solely for the reason of the change and there could be a new attrition challenge to address.

The software development companies will be critically hit in such migration from corporate work space to home workspace.

The trend is like the “Stockholm Syndrom” exhibited by kidnap victims as more and more COVID lockdown victims start falling in love with the new paradigm of work. This could both be a threat and an opportunity for the innovative HR Professionals.

It looks exciting opportunities ahead for HR managers who can think differently and adopt their skills to the new environment. Management schools have to look at “HR Management in a Virtual Environment” as a new area of specialization.

Let us keep our thoughts on this emerging area of learning which is as important as “Security or Privacy Management in a Virtual Environment”

Naavi