To

All Information Security Auditors

From Naavi, FDPPI

Dear Friend

This communication is for all of you who are professionals in the area of Information Security. I trust many of you are certified for your expertise from various organizations.

You could be a Lead auditor for ISO, You could be a PDPSE or CISA from ISACA, You could be a CISSP certificate holder . You could also be a IAPP or DSCI certified Privacy professional.

You could also be a Chartered Accountant or a Company Secretary or a Cost Accountant and member of CMA and advising and auditing your clients on various aspects of business.

It is my pleasure to invite you all for the two day event of FDPPI at Bangalore on 30th November and 1st December 2024.

This is the flagship event of FDPPI and the fifth in the series started in 2020. This year our co-organizer is KLE Law College and the event will happen in their auditorium at Ullal, Bengaluru.

This is a premier international event with speakers from India and abroad sharing their views on Privacy and Data Protection in the era of AI and Robotics. The legal aspects of DPDPA in India, EU Ai Act in Europe as well as many of the recent laws in USA are being discussed by professionals.

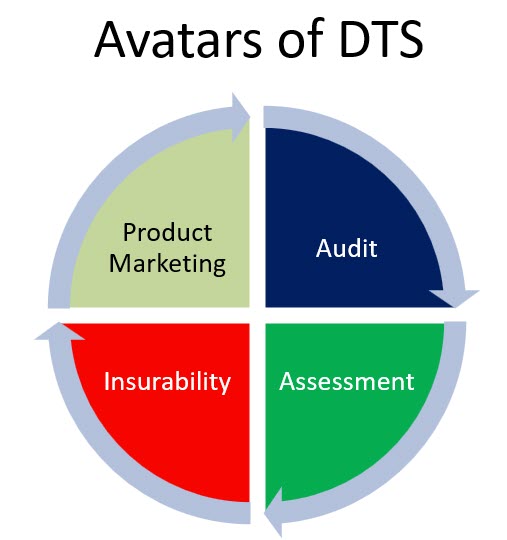

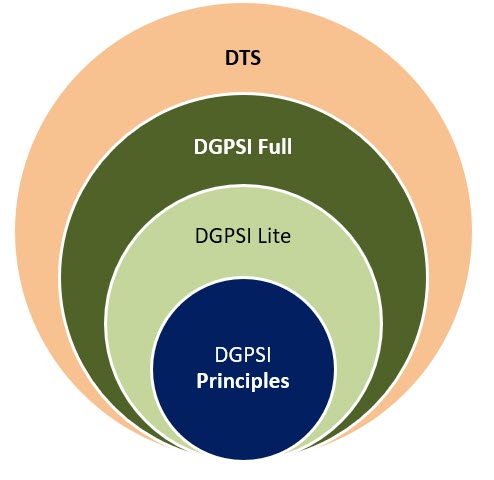

There is a special focussed session directed to Data Auditors which is a new profession emerging in India consequent to DPDPA 2023.

In this session we will discuss the concept of Data Auditors as envisaged in DPDPA 2023 and what are the professional opportunities in this domain.

We will also discuss how the those who are currently in different audit professions can add Data Audit to their portfolio. This will be a unique session which could provide you new insights to the emerging opportunities.

Please look at the full details of the conference available a www.idps2024.in.

This is an event which you cannot miss. Register today and book your presence. It will be our pleasure to meet you all and exchange professional thoughts. If you are not able to attend physically, explore attending virtually since this is a hybrid event.

Regards

Naavi